JP Morgan

-

Tao Weng, a former syndicate banker at JP Morgan, has switched to the buy-side to run Asia Pacific equity capital markets for hedge fund ExodusPoint Capital Management.

-

The European Central Bank's various purchase programmes are set to continue shaping covered bond issuance next year, but away from the reach of the ECB, more niche markets are expected to flourish. Collected below is a selection of GlobalCapital’s covered bond outlooks for next year.

-

The sterling corporate bond market may need to rely on the Bank of England stepping in with corporate bond purchases in the case of a no-deal Brexit, as politicians take negotiations over the UK's future relationship with the EU to the wire.

-

Nobody will forget 2020 in a hurry. It was the year in which a coronavirus pandemic swept across the globe, created economic chaos and forced central banks into swift action. The resulting measures helped to underpin financial markets, bringing yields from record highs in March to record lows in December. But the outlook has always remained uncertain for banks and insurance companies, whose balance sheets are yet to feel the full impact of the crisis. In such a testing year, GlobalCapital wanted to reward the bond deals that achieved stand-out results for issuers — in terms of pricing, execution and timing. The winners are presented here.

-

Despite funding stresses in certain Latin American countries, bond markets will continue to help the region with its financing needs. For now, this eases the pressure for reform and fiscal consolidation, but issuers must eventually face up to political and social turbulence. Oliver West reports.

-

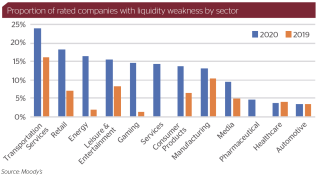

The coronavirus has smashed the usual hierarchy of companies, large and small, creating new winners — and many losers. While 2020 was about finding ways to keep their financial lifeblood flowing, in 2021, more permanent solutions will need to be found. This will include bond funding for those still shut out — and M&A. Mike Turner reports.

-

US-listed Chinese companies have raised more than $12bn from equity investors in the past month, with iQiyi becoming the latest to simultaneously sell a convertible bond and price a follow-on offering of its American depositary shares. With valuations soaring for many of these stocks, bankers expect more issuers to jump into the market in 2021, writes Jonathan Breen.

-

Embassy Office Parks Real Estate Investment Trust has has raised Rp36.84bn ($500.9m) from an issue of new stock, according to a source close to the deal.

-

Chinese streaming platform iQiyi has kicked off a combined convertible bond and follow-on offering that could raise around $1.7bn.

-

Aabar Investments has pocketed MR932.4m ($229.4m) after selling down its remaining position in Malaysia’s RHB Bank, according to a source close to the deal.

-

AstraZeneca, the UK pharmaceuticals company, has lined up $17.5bn of bridge loans from three banks to back its $39bn acquisition of US biotech firm Alexion.

-

Country Garden Services Holdings Company has raised HK$7.785bn ($1bn) from a placement of new shares, riding on strong investor interest in property management services companies over the past year.