Ireland

-

-

Four sovereign, supranational and agency borrowers came to market for euros in the opening week of 2017, showcasing the market’s depth and flexibility. But the torrent of supply has meant that issuers haven’t had it all their own way.

-

KfW and Ireland brought euro deals on Wednesday at the very top end of size expectations, alleviating a little of the pressure on what is set to be an extremely busy year in the currency. The trades came the same day as Municipality Finance mandated for a euro benchmark and a request for proposals came from the European Financial Stability Facility.

-

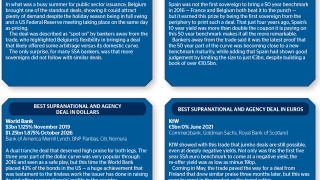

As a year where political upsets became the norm drew to a close, GlobalCapital picks the standout trades from a turbulent 2016.

-

Irish funds could soon be making waves in China’s onshore capital markets thanks to a Rmb50bn ($7.2bn) Renminbi Qualified Institutional Investor (RQFII) quota awarded to Ireland this week.

-

Shares in Greencore, the Anglo-Irish sandwich and convenience food producer, closed 3% higher on Wednesday after it completed its £439m rights issue to finance its acquisition of Peacock Foods, a US competitor.

-

The Irish National Treasury Management Agency has set a higher funding target for 2017 than its 2016 figure, according to a funding statement released on Wednesday.

-

Bank of Communications Financial Leasing opened the week with a rare structured finance transaction on Monday, attracting bids for a $300m dual-tranche offering backed by loans that are secured by aircraft assets.

-

Shares in Bank of Ireland, the Irish lender, fell 3.7% on Friday after Fairfax Financial Holdings, the Canadian insurer controlled by billionaire Prem Watsa, sold half its remaining stake through a daytime accelerated bookbuild.

-

Greencore Group, the Irish convenience food supplier, has announced plans for a £439m rights issue to partly finance its takeover of Peacock Foods, a US competitor, alongside its preliminary full year results on Monday.

-

The Irish and Luxembourg subsidiaries of Depfa Bank confirmed that they bought a combined €4.8bn covered bonds from FMS Wertmanagement (FMS-WM) which will be cancelled with the underlying assets sold back to the state-owned wind down agency, of which it is a wholly owned subsidiary.

-