HSBC

-

Lancashire Holdings issued its first subordinated bond this week, a Reg S dollar tier two. There has been a near complete absence of insurance capital trades from the euro and dollar markets so far this year, but bankers are confident that more will follow.

-

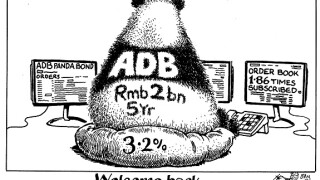

The Asian Development Bank broke a decade-long absence from China’s domestic market to price a Rmb2bn ($307m) Panda bond at a record low spread this week. Its assistant treasurer told GlobalCapital that the multilateral development bank is open to selling longer dated and green renminbi-denominated deals. Addison Gong reports.

-

Secondary listings in Hong Kong got a fresh boost this week with online car marketplace Autohome pricing its deal and internet giant Baidu getting ready to roll out its transaction. More homecomings by US-listed Chinese companies are in the pipeline, but the number of viable candidates is shrinking, writes Jonathan Breen.

-

Coupang, a South Korean e-commerce company, scooped up $4.2bn from its IPO this week, after pricing the deal above the marketed range. It is the largest US listing from Asia since Alibaba Group Holding raised $25bn seven years ago.

-

Tricor Holdings is planning a return to the loan market to refinance a HK$2.8bn ($360m) borrowing it sealed in 2016 for a leveraged buyout by investment firm Permira.

-

Asia’s debt market was hit with volatility this week, putting pressure on secondary trading, denting primary bond supply and forcing investment grade borrower Indian Railway Finance Corp to pull its dollar transaction. Is there any respite on the way? Morgan Davis finds out.

-

Woori Card Co, a South Korean financial services firm, targeted investors in Taiwan on Wednesday for a $200m social bond.

-

HSBC has agreed to tighten its policies on climate transition and coal funding, in response to a shareholder motion calling on it to phase out fossil fuel financing. The move underlines the power investors have to accelerate change on environmental and social issues using shareholder votes, and could raise the bar for other banks.

-

NRW.Bank will be the next public sector borrower to hit the sterling market following an improved funding cost in the currency versus euros and dollars.

-

Oman's Bank Muscat this week returned to debt markets after a brief hiatus to sell a dollar bond. The deal was one of only a few across CEEMEA this week, as market participants say interest rate volatility is still deterring issuance.

-

WH Smith, the UK high street retailer, has extended its bank term credit lines and cancelled a crisis liquidity facility, as the borrower posted better than expected trading figures since the start of the year.

-

US-listed Autohome, an online car marketplace, has wrapped up its HK$5.34bn ($687.8m) secondary offering in Hong Kong, pricing the deal even as its US stock dived amid a market rout.