Issues

-

Market participants hope more jurisdictions will follow as Canadian duo attract record demand

-

Mining merger rewards patient followers of this industry

-

There is no sign of investor appetite for new CEEMEA bonds slowing down

-

KfW's Piet Jürging and Petra Wehlert discuss recent deals and the dollar's competitiveness

-

There are two IPO markets — and the boring one is best

-

Other sovereigns can learn a lot from how Turkey navigates the public bond market

-

Loans to sectors linked to government spending or regulation could be impacted

-

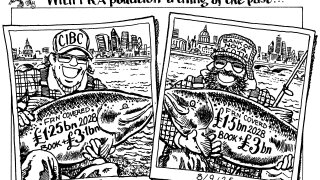

VW also priced UK car loan deal, increased to £750m

-

Paper could arrive on Monday or Tuesday, ahead of flagship covered market event

-

Global head of funding Andrea Dore on this week's sterling and dollar transactions

-

The sovereign has had a busy year of issuance and liability management

-

Project financings have stood out so far this year