Issues

-

Working hard is one thing — unnecessary requests on days off are quite unreasonable

-

Eleven banks in deal, down from 13 last time

-

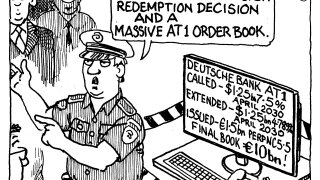

◆ New euro deal more than 6.5 times subscribed ◆ Comes one trading day after a call and non-call decision on two dollar AT1s ◆ Visible new issue premium helps attract orders

-

Ethan Sawyer and Carmine Visconti are the Swiss bank's latest TMT hires

-

◆ Swedish issuer starts tight ◆ Deal lands close to recent SSA supply ◆ Seven year tenor offers investors something different

-

◆ Managing the go-no go call ◆ 'Granular' conversations on social label ◆ AT1 redemptions and offsets in balance sheet

-

New bonds from Turkey won't appear until late April, said one investor

-

◆ UK fires starting pistol on digital Gilts ◆ SSA market absorbs EU defence funding detail ◆ Credit issuers adjust tactics

-

Paulson exits Alpha Bank with block trade

-

Real Gilt on blockchain will force market to address technical, legal and risk challenges

-

◆ Three banks raise dollar funding with single digit premium ◆ ING moved through 'right window' to issue its first Yankee of year ◆ NatWest opts for four-part opco print

-

Greater concessions nip nervousness and orderbook attrition in the bud