Issues

-

Improving sentiment lures retail giant but issuer opts for short end

-

A wide spectrum of borrowers eyeing primary market after weeks of pause

-

As tariff storm eases, buyers grow more willing to move down the credit curve

-

In recent weeks, private credit and direct lenders have brought more certainty to borrowers as capital markets were roiled by tariff chaos

-

German and Greek listings set to be first since US tariffs announced

-

◆ Nordea and CM Arkéa resume European senior funding absent since 'Liberation Day' ◆ Nordea likely to serve as floor for spreads in current market ◆ Arkéa goes slightly longer in its first deal of the year

-

◆ Undersupplied insurance sector lures buyers ◆ Bankers debate best comparables ◆ AT1 market reopens (sort of)

-

‘A strong focus on a fast execution process’ aimed to minimise uncertainty and volatility, says sovereign’s funding head

-

◆ New investors take part in 1.5 day sale ◆ Deal lands flat to peers ◆ Picking the right window 'difficult'

-

◆ Japanese issuer back with usual benchmark ◆ Difficult backdrop, ‘good for them to get this away’ ◆ Tier one issuer needed

-

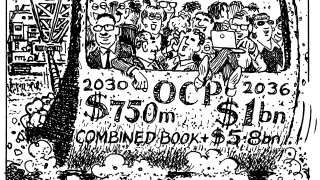

◆ Bill Ackman’s firm offers chunky spread ◆ But investors only offer modest demand ◆ Company only has one other euro trade outstanding

-

Veteran joins from UniCredit