Free content

-

SSA market most bullish but some in credit, emerging and equity markets still unconvinced anything has changed despite 90 day tariff reprieve

-

By neglecting its own reporting rules, Fed risks weakening global banking system

-

Banks could get stuck with large exposures they cannot offload

-

By plunging the US into a recession, Trump might get his rate cut wish

-

-

◆ How US tariffs will affect bond issuers in the medium and long term◆ Liberation Day: your funniest quotes ◆ A funding update from KfW's head of capital markets, Petra Wehlert

-

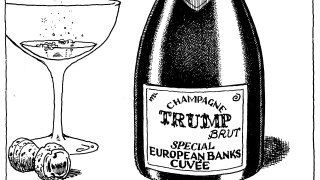

US stocks have been the big loser, while European banks could reap profits

-

Enthusiasm for a defence push on the continent is crucial but lacking

-

-

Clear success of Tuesday's euro corporate bond issues should give others confidence

-

The pay-off of keeping work at bay when it comes to family is bigger than the downside

-

◆ Farewell, KommuneKredit ◆ Covered bonds advance on SSAs’ territory ◆ Ivory Coast makes funding breakthrough ◆ Romania’s risks