Free content

-

The more infectious new variant of the coronavirus has rattled Europe, plunging major economies back into lockdowns. This is already reshaping January’s usually lethargic pace of high grade corporate bond issuance and market participants should expect a frenetic start to the year.

-

For years, meeting obligations has been the be-all and end-all of emerging market debt management. Pay your debts, or wave goodbye to international investors.

-

If 2020 was all about piling on the debt as governments around the world rushed to save their economies and societies, 2021 will be all about working out ways to reduce it — or at least sustain it.

-

The closing of borders between mainland Europe and the UK has provided a brief glimpse into the chaos that the immediate imposition of trading restrictions between the UK and EU might caused in the event of a no-deal Brexit on December 31. Both sides need to work around the clock to finalise a deal with a generous implementation period to avoid the kind of nightmare scenario that could lead to investors fleeing the UK.

-

Christmas may be upon us, but that hasn't prevented a late flurry of people moves in investment banking. Credit Suisse has hired Deutsche Bank's head of corporate broking: Matt Hall is moving over to become vice chairman of UK investment banking.

-

In November, GlobalCapital polled loan market participants for its 18th Syndicated Loan and Leveraged Finance Awards. The nominations are listed below, in alphabetical order. We will reveal the winners at a virtual event in February. Further details on the event will be laid out on our website in January. We congratulate the nominees.

-

In early July, a cub reporter who had only left university the year before filed a story that would cause UK fast fashion company Boohoo’s share price to tumble.

-

This week in Keeping Tabs: Republicans battle over Federal Reserve support, a look back at the "Spanish" flu, and a quiz from the Bank of England.

-

In the second part of GlobalCapital China’s awards announcements, we reveal the winning banks across Panda bonds and ABS, as well as the best bank for securities services.

-

GlobalCapital China is pleased to announce the winners of its annual awards, recognising the banks, issuers and individuals that have made the biggest contribution to developing China’s onshore markets. In part one, we reveal the most impressive issuers in the FIG, corporate and SSA categories.

-

In the final part of GlobalCapital China’s awards announcements, we reveal the year’s key innovation – and the individual who has made the greatest contribution to reforming and internationalising the onshore market.

-

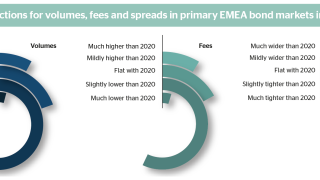

Public sector bond issuers surprised on the upside in 2020. In 2021, banks predict them to be big borrowers again — and they expect to make money from them. Twenty-six heads of debt capital markets in the EMEA market participated in Toby Fildes’ annual outlook survey. Only a few firms are expecting to have to cut jobs, but the UK will bear the brunt. On the eve of Brexit taking full effect, Paris, Frankfurt and Dublin look set to be the winning cities. Good news for all: 80% of banks see the last significant Covid restrictions being lifted by the second half of 2021.