Free content

-

In this table, GlobalCapital Asia offers a glimpse of the bond deals that are in the works in the region.

-

This round-up focuses on the establishment of a new stock exchange in Beijing, and the central bank’s annual stress test for Chinese lenders

-

Hayes claims the banks knew exactly what the traders were doing and that his sentence was an 'absolute joke'

-

Capital markets bankers are starting to prepare for the inevitable return of the roadshow

-

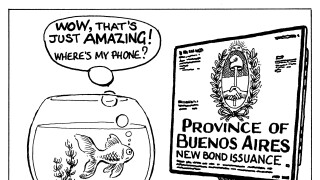

Shunted bondholders feel the Province of Buenos Aires’ coercive negotiation tactics will hurt its reputation in credit markets, but investors rarely have such long memories

-

I miss the good ol' days when I worked hard to win business. The younger generation have new tricks up their sleeves

-

In this table, GlobalCapital Asia offers a glimpse of the bond deals that are in the works in the region.

-

Rising leverage ratios in Asia’s normally conservative loan market will require banks to perform a careful balancing act

-

The return of rising stars to their rightful place in the IG firmament will give a truer picture of levfin volumes

-

It's time to accept the truth about quantitative easing

-

The recent resurgence of retail investing in the US could serve as a cautionary tale

-

In this table, GlobalCapital Asia offers a glimpse of the bond deals that are in the works in the region.