Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

◆ Insurance companies anchor long dated green tranche with near-4% yield ◆ Curve extension debated ◆ Deal comes amid widening secondary spreads but lands with negligible premium

◆ 52bp reoffer equals Nordea’s multi-year record ◆ ‘Insane’ levels show FIG spread compression, rival banker said ◆ Buy-and-hold investors prioritised

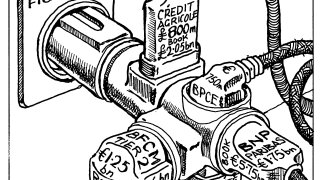

Favourable market conditions have made raising debt like 'fishing with dynamite' for bank issuers. But concerns are mounting about volatility ahead

◆ Second ever bond for the issuer ◆ Deal marketed to both SSA and credit investors ◆ Offers potential for tightening on the back of southern European convergence trade

More articles/Ad

More articles/Ad

More articles

-

◆ RV in sterling turns less favourable for issuers ◆ Investors 'underwater' on recent deals ◆ Asset managers see 'no fundamental change' in UK financials from higher Gilt yields

-

◆ Relative value versus covered bonds reduces senior paper's appeal ◆ RBC prices flat to USD curve ◆ Spread differential to other CAD issuers

-

◆ Rival bankers disagree on fair value ◆ Technicals favour senior-non preferred ◆ LBBW mandates euro SNP deal

-

International banks launched a torrent of dollar FIG supply as they swatted away political uncertainty to get 2025 off to a rapid start

-

Warm reception for French banks in euros and other currencies shows FIG market is in positive health

-

◆ Landesbank delays covered funding as it prints second senior preferred three months after debut ◆ Varying views on concession, minimum 5bp paid ◆ Strong backing by German bank investors