Top Section/Ad

Top Section/Ad

Most recent

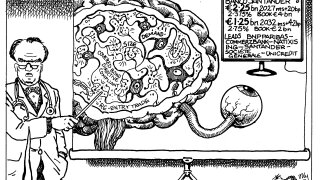

◆ Italian bank increased benchmark size to €750m ◆ Deal expected to perform in secondary ◆ Covered was one of two issued on Thursday

◆ Canadian bank lands tightest euro covered this year ◆ Further Canadian issuance on the day ◆ Banker on the deal said tranches were priced just inside fair value

◆ Austrian bank's first covered in nearly two years ◆ Both tranches offered 5bp of NIP says banker ◆ Modest 3bp tightening reflects 'normalisation' of covered market

◆ German bank secured spread tightening across tranches◆ Banker said first tranche offered small NIP but second had nothing ◆ Tuesday’s deals failed to deliver the spectacular order books of last week

More articles/Ad

More articles/Ad

More articles

-

The two-part deal was a ‘no-brainer’ due to its generous pick-up and high yield

-

Credit Agricole Next Bank wasn’t the only major bank of French origin in the Swiss franc market on Tuesday

-

RFLB NW's competing Austrian 10 year proved trickier to sell

-

Three issuers have mandated leads for for follow-on deals

-

Execution compared more favourably to a competing deal in the same tenor from NAB

-

The four year sale landed with 3bp of premium after an aggressive start