Top Section/Ad

Top Section/Ad

Most recent

◆ Italian bank increased benchmark size to €750m ◆ Deal expected to perform in secondary ◆ Covered was one of two issued on Thursday

◆ Canadian bank lands tightest euro covered this year ◆ Further Canadian issuance on the day ◆ Banker on the deal said tranches were priced just inside fair value

◆ Austrian bank's first covered in nearly two years ◆ Both tranches offered 5bp of NIP says banker ◆ Modest 3bp tightening reflects 'normalisation' of covered market

◆ German bank secured spread tightening across tranches◆ Banker said first tranche offered small NIP but second had nothing ◆ Tuesday’s deals failed to deliver the spectacular order books of last week

More articles/Ad

More articles/Ad

More articles

-

◆ New deal offers half the spread of the last one ◆ Investors pile into rare trade's book ◆ Pick up provided over govvies

-

◆ South Korean lender enters sterling for the first time ◆ Spread move the biggest in 18 months ◆ Deal lands flat to fair value and euros

-

◆ Higher spread deals from established jurisdictions attract demand ◆ RLB Steiermark returns after more than two years away ◆ No premium needed for CCF's third of 2025

-

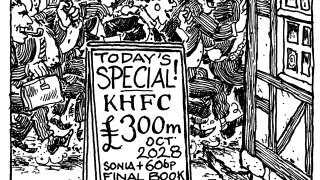

◆ No premium needed for 'well-funded' name ◆ Final book the biggest in four weeks ◆ Deal attracts strong asset manager bid

-

◆ Demand sticky despite tight spread ◆ Next to no concession offered ◆ Pick-up to SSAs not a concern

-

◆ Dutch bank takes €1.5bn at four years ◆ Little resistance to pricing through 20bp ◆ Sticky book allows for tight final level