Top Section/Ad

Top Section/Ad

Most recent

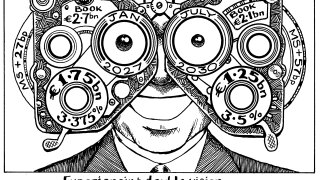

Covered bond redemptions are set to increase by €20bn next year and €30bn in 2027

Strong demand for slim supply could tempt issuers to access the market before Christmas

No investors involved in Caffil's latest deal mentioned concerns over French risk

Issuers' desire to put covered pre-funding to one side suggests concerns over bumps ahead

More articles/Ad

More articles/Ad

More articles

-

Asset managers are ruling the roost

-

Key central bank policy meetings have cleared the air, but confidence is lacking

-

The best banks, issuers, platform providers and deals of 2023 will be announced at a gala industry dinner in Munich on September 14

-

UniCredit Italy sets a strong precedent many of its national peers plan to follow

-

◆ Capped sales surpass expectations ◆ Fixed sizes could help as covered funders push out along the curve

-

Longer funding offers issuers efficient use of collateral that's worth paying for