Top Section/Ad

Top Section/Ad

Most recent

Covered bond redemptions are set to increase by €20bn next year and €30bn in 2027

Strong demand for slim supply could tempt issuers to access the market before Christmas

No investors involved in Caffil's latest deal mentioned concerns over French risk

Issuers' desire to put covered pre-funding to one side suggests concerns over bumps ahead

More articles/Ad

More articles/Ad

More articles

-

As the going got tough, the tough got their deals done leading to hopes of AT1s and Italian covered bonds

-

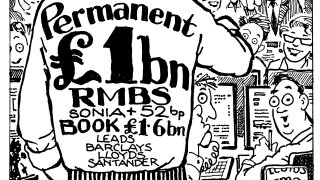

Prime UK RMBS issuers take advantage of strong technicals

-

The CRE market has yet to stabilise, with bids and offers far apart

-

Issuers not expected to surface until early June

-

BMO, RBC and BNS have taken on new staff to capture on juicy FIG fees

-

Issuers plan to reopen the long end but no urgency to do so