Euro

-

◆ Issuer waited for stable market ◆ Mixed views on concession ◆ Deal gives 'capital structure arb'

-

Founder Matthew Moulding injects £60m while extending a term loan and revolver

-

◆ Issuer strikes 'fine balance', prioritising size ◆ Pricing came in line with recent peers and KfW ◆ Have 10 year Länder bonds found their level?

-

◆ Value versus domestic curve debated ◆ Scarce Nordic tier two supply helped trade ◆ Nordic names 'still performing during volatility'

-

◆ Curves steepen in euros ◆ Issuers pull triggers as holiday-strewn calendar looms ◆ Single digit new issue concessions for most

-

Subordinated deals make up a larger share of March's supply than usual

-

North Rhine-Westphalia will get "a lot of legroom" to expand investments, treasurer says

-

◆ MetLife returns to euros after January print ◆ Offers high single digit premium but comes flat to dollars ◆ BlackRock next with rare refi of its only non-dollar bond

-

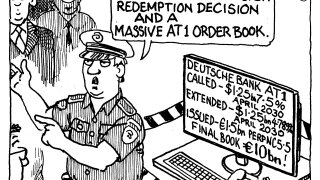

◆ New euro deal more than 6.5 times subscribed ◆ Comes one trading day after a call and non-call decision on two dollar AT1s ◆ Visible new issue premium helps attract orders

-

Half a dozen syndicated deals in euros and dollars to kickstart new week

-

◆ Swedish issuer starts tight ◆ Deal lands close to recent SSA supply ◆ Seven year tenor offers investors something different

-

◆ Managing the go-no go call ◆ 'Granular' conversations on social label ◆ AT1 redemptions and offsets in balance sheet