Euro

-

◆ Bund trades 'risk-off' amid tariff caution ◆ EGB secondary hindered by summer illiquidity ◆ SSA issuance expected via taps and MTNs

-

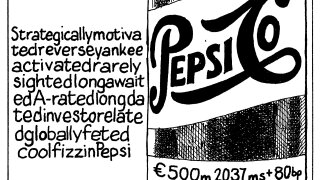

◆ Order book lifts size to €600m ◆ Deal lands flat to fair value ◆ US credits enjoy brisk summer sales in Europe

-

Appetite for long‑dated MTNs firm in quiet summer market, say bankers

-

Hundreds of billions of euros of joint debt needs to be agreed upon before 2028, but many questions unanswered

-

Budget induced volatility could push OATs above covered spreads across the curve

-

Lull in issuance imminent but searing hot market could entice more borrowers before party ends

-

Strong corporate demand bodes well for the rest of the credit market

-

◆ Expectations for ECB rate cut decline ◆ August 18 issuance restart expected ◆ Dollar pipeline builds as Japan SSAs 'cheap'

-

One major bank has underwritten three infra deals in the last week

-

◆ Real estate company tightens hard on spread ◆ Deal lands well inside fair value… ◆ …but order book shrinks substantially as a result

-

BPM spreads 'unlikely' to widen as issuer remains 'a takeover target'

-

◆ US delivery firm prints seven and 12 year bonds ◆ Equal spread tightening on both tranches ◆ Investors flush with cash jostle for scarce issuance