Euro

-

Spread widening brings unexpected shift in orderbook composition in euros but other currencies tougher

-

German utility soothes flighty bond investors by mixing up usual market approach

-

Supranational remains ahead of the curve in completing its 2024-2025 funding task

-

◆ Tight govvie spread no problem for spread hunters ◆ No premium needed ◆ Some buyers resisted pricing through 70bp

-

Development bank aims to continue early success in the dollar market next week

-

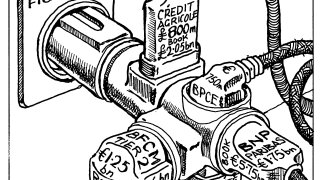

Warm reception for French banks in euros and other currencies shows FIG market is in positive health

-

Elite group of companies now considered safer than France in the primary market

-

Last January's book and deal size records tumble to encourage bankers with 'trillions' of issuance still to be digested

-

◆ Landesbank delays covered funding as it prints second senior preferred three months after debut ◆ Varying views on concession, minimum 5bp paid ◆ Strong backing by German bank investors

-

◆ Italian bank overcomes slower day in primary with first FIG dual tranche deal of year ◆ Why issuer chose twin tranches ◆ Concession discussed

-

◆ French bank prints third syndicated deal in just two days ◆ Frequency of visits means issuer has to pay up ◆ Euro tier two ‘better received’ than sterling tier two

-

Big books and negative concessions aplenty as pipeline looks thin