Top Section/Ad

Top Section/Ad

Most recent

International tension has propelled valuations in the sector up, tempting issuers

Czech defence firm priced at a discount to German competitor Rheinmetall

Czech defence firm set for largest European IPO since Porsche's 2022 listing

Listing meant to give government fiscal breathing room

More articles/Ad

More articles/Ad

More articles

-

Shares in Allfunds, the B2B fund distribution platform, rocketed on Friday, their first day of trading in Amsterdam. The news was a bonus for an IPO market which had started to stutter. This week Synlab the German laboratory technology company has struggled to get its IPO covered and the listing of Trustly, the Swedish fintech unicorn has been pulled.

-

Chinese health insurance and healthcare crowdfunding platform Waterdrop has kicked off pre-deal investor education for its US listing, according to a source close to the IPO.

-

Top Glove Corp, the world’s largest manufacturer of rubber gloves, has revised its planned Hong Kong listing down to a size of HK$6.9bn ($889m).

-

The IPO of Allfunds was covered well in excess of the deal size on Thursday morning, proving that some deals in the European IPO market still attract strong demand.

-

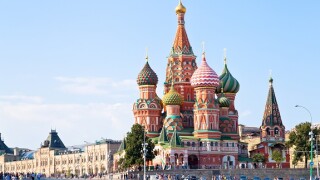

Segezha, the Russian paper and pulp company, has set a price range on its IPO despite the growing pressure faced by Russian companies as hostility between the country and the US increases.

-

The IPO of PolyPeptide, the Swiss pharmaceutical ingredients company, was covered on the first morning of bookbuilding on Wednesday, according to sources close to the deal.