EMEA

-

Lull in issuance imminent but searing hot market could entice more borrowers before party ends

-

Hunt is on for ready issuers after bond prices recover

-

Third Saudi capital markets banker to leave in recent months

-

One major bank has underwritten three infra deals in the last week

-

◆ Real estate company tightens hard on spread ◆ Deal lands well inside fair value… ◆ …but order book shrinks substantially as a result

-

If Romania can tackle its deficit then government and state-owned issuer borrowing costs will fall

-

-

◆ US delivery firm prints seven and 12 year bonds ◆ Equal spread tightening on both tranches ◆ Investors flush with cash jostle for scarce issuance

-

Vicenza, Verona and Grezzana look to improve electricity services

-

◆ Debut issuer draws solid demand ◆ Orderbook almost touches £1bn at peak ◆ Investors see triple B corporate sterling as enticing prospect

-

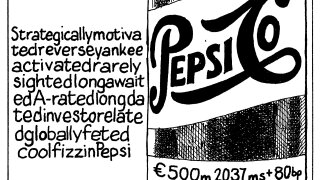

Deal is first in format from an EM sovereign since 2023

-

French risk ‘the known unknown’ and will ‘get serious' come autumn