EMEA

-

Hints about quantitative tightening could be the main focus

-

Most lenders from 2019 SLL returned for this financing

-

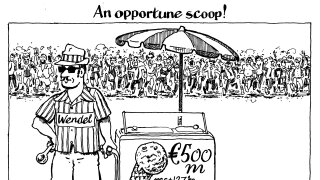

◆ Wendel’s decision to refinance bonds early pays off for company ◆ Demand for €500m trade hits €3.1bn ◆ Spread thunders in by 38bp during bookbuilding

-

Sentiment towards affected major banks improves but major ratings agency judges overall situation credit negative

-

Deal is a mix of green private placements, term loans and revolving credit facilities

-

Borrower refinancing 2027s to take advantage of lack of competition in bond market

-

The emirate has not printed in the public markets since 2024

-

Activity brewing suggests loan deal making will pick up later this year

-

Second tier issuers already eying September for deals

-

French banking groups seen as most likely candidates to step up capital issuance from their insurance arms

-

UK water companies rally as Cunliffe review promises seismic change

-

◆ Deal follows $3bn issue in February ◆ Swiss regulators may demand much more capital ◆ Similar structure to last deal