EMEA

-

Marco Ferrari joins Stockholm office from Nordea

-

Bank is offering the first AT1 from Turkey since January

-

◆ Rival bankers discuss pricing approach ◆ Debate on whether IPTs start wider now ◆ Austrian syndication targets 'sweet spot' and draws bids

-

◆ French government at risk of collapsing, again ◆ 'Roller-coaster ride' but issuer comes out unscathed ◆ Finding a 'good starting point' key

-

Retail sector issuers among those eying debut deals

-

◆ Scottish utility prints eight year green bond ◆ Order book peaks at more than three times covered ◆ Small new issue premium paid

-

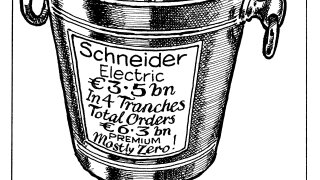

◆ French issuer prints two year floater and four, 6.5 and 12 year bonds ◆ Peak demand tops €11bn across the four tranches ◆ 12 year bond attracts the largest final book

-

◆ Softer open no problem for Dutch bank ◆ Market ready and willing to buy size ◆ Investors show large preference for one tranche over the other

-

◆ Asia Pacific pair tick investor boxes ◆ Solid demand despite tight spreads ◆ Premiums vanish in euros

-

Volume for 2025's reopening week is billions down on 2024

-

Regulatory capital is making up a much bigger proportion of Gulf FIG issuance in 2025

-

The bank has 'picked the right moment', said one investor