Middle East Bonds

-

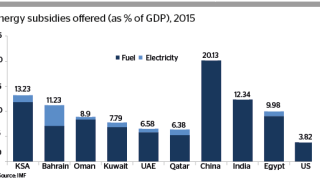

Oil prices are central to the economies of the Middle East so the commodity price collapse of the last year has had a big impact. But how bad is the outlook for growth and government finances? Chris Wright assesses the situation.

-

Falling oil prices, escalating geopolitical tensions and now a slew of ratings downgrades — the Middle East’s sovereign borrowers have a lot to contend with. But strong local demand and appropriate spreads should ensure ample funding is raised this year, writes Virginia Furness.

-

The fiscal strain of low oil prices in the Middle East has prompted international investors to flee the region. Spreads have blown out but issuers need funding. That means the sukuk market could be about to come to the rescue, writes Virginia Furness.

-

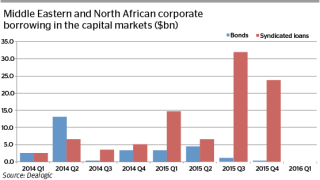

The loan market has provided ample support for corporates across the Gulf Co-operation Council (GCC) and Egypt in the last 18 months. This will continue, but issuers will also reacquaint themselves with the bond market with innovative products this year, writes Elly Whitaker.

-

The liquidity crunch in the Middle East may have positive consequences for the development of infrastructure finance in the region — and in particular the role of private capital, says Chris Wright.

-

A swathe of ratings downgrades. one of which prompted Bahrain to first cancel a tap and then reprint it this week at a higher yield, is just one factor that will force Middle East sovereigns to pay up for bond funding just when they need it the most, writes Virginia Furness.

-

-

Bahrain’s decision to revive last week's cancelled bond sale was driven by reverse enquiry from investors who were unperturbed by the issuer’s new junk status, according to bankers on the deal.

-

HSBC Group’s Middle East business took a $300m hit in 2015, mainly due to higher loan impairment costs as the bank expects an increase in loan defaults in the UAE, according to its annual report.

-

The Islamic Development Bank is embarking on a three day sukuk roadshow, starting on Sunday.

-

The Kingdom of Bahrain has returned to tap bonds less than a week after an unexpected Standard & Poor’s downgrade led to the issuer cancelling a $750m dual tranche bond increase. Rival bankers said the strategy was right, but were surprised by the tight pricing offered.

-

Bahrain’s decision to pull its $750m tap on Thursday was hailed by some as a prudent move to protect investors, but aggressive secondary market action following the downgrade has still left some smarting, writes Virginia Furness.