Derivs - Credit

-

Dealers of private EMTNs: Non-syndicated deals for <= €300m excluding financial repackaged SPVs, GSE issuers, self-led deals and issues with a term of < 365 days Dealers of private EMTNs including self-led: Non-syndicated deals for <= €300m excluding financial repackaged SPVs, GSE issuers and issues with a term of < 365 days Dealers of structured EMTNs including self-led: Structured, non-syndicated deals for <= €300m excluding financial repackaged SPVs, GSE issuers, puttable FRNs and issues with a term of < 365 days

-

Dealogic league tables of ECM transactions, last 12 months rolling.

-

Barclays has seen a slew of senior officials depart from its investment banking division in Asia Pacific, including Jim Vore, managing director in credit sales in Singapore.

-

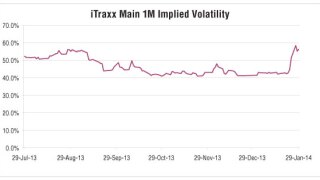

Fast money investors and loan desks have been seen buying short-dated and slightly out-of-the-money iTraxx Main receivers this week, after the index moved in an intraday range of nine basis points and five bps in the last two days.

-

Hedge funds and real money players have been seen selling 10 year protection and buying 5 year protection on the iTraxx Main to play the flattening of the 5-10y curve.

-

The credit markets experienced a torrid end to the week after Chinese PMI data raised concerns about a potential hard landing for the world’s second-biggest economy.

-

Hedge funds are extending the expiries on credit options in the iTraxx Main out to June, the first time significant flow has occurred in such longer-dated maturities this year. The flow comes as investors seek to profit from the roll of the index on March 19 and hedge for events later in the year.

-

Amundi Asset Management has separately profited from a single name basis trade on Finmeccanica, the Italy-based aerospace and defense company, as well as a relative value trade that positioned long risk Intesa Sanpaolo and short risk Mediobanca.

-

Newly created domestic central counterparties in Asia may largely lose out to international CCPs following the introduction of mandatory clearing this year.

-

DBS Bank in Hong Kong is looking to market equity-linked notes denominated in renminbi that reference an equity underlying in Hong Kong. The issuance is based on the view that there will likely be a relaxation in RMB convertibility, which will spur demand for such structures.

-

Hedge funds and real money accounts are selling ladders and payer spreads on iTraxx Main and Crossover to take advantage of the steep volatility smile on the indices, with the view that current tight spreads can only be sustained until April, according to Cedric Lespiau, head of credit index and options at Société Générale in London.

-

UBS has hired Evan Li, a former associate at PIMCO in Singapore, as an Asia G3 credit trader.