Derivs - Credit

-

U.K. supermarket chain WM Morrison was a notable underperformer this week amid reports that it could restructure its property portfolio–to the detriment of credit investors.

-

Strategists at Société Générale are recommending investors sell five-year credit default swaps on Wendel, the French investment company, noting that CDS on the name are trading too wide in relation to other BB+ rated credits and the likelihood it will be upgraded to investment grade status as early as first quarter 2014.

-

European and U.S. hedge funds with a bullish view on Europe are going long the Eurostoxx 50 and short the iTraxx Main.

-

Standard Chartered is looking to launch a distribution platform within two months for a number of tradable custom indices, which will reference varied asset classes including equity, credit and high yield.

-

Standard Life Investments has launched a short duration credit fund that uses derivatives to reduce the duration inherent in the corporate bonds it holds. The fund is derived from the conversion of the firm’s Standard Life Investments’ Select Income Fund which took place Jan. 8.

-

Sammy Mohammad, an ex-managing director at the institutional client group at Deutsche Bank in London, has joined StormHarbour in senior sales and trading in London.

-

Fast money investors are selling at-the-money credit options and buying back out-of-the-money payers that were sold before the Christmas lull to hedge long cash positions.

-

Assenagon Asset Management is using an equity derivatives model to assess the fair value of contingent convertible bonds—known as CoCos—and subsequently identify investment opportunities.

-

A proposed amendment to South Korea’s Commercial Act Enforcement Decree will allow firms to set off unrealized gains arising from hedging derivatives against the unrealized losses of the underlying transactions.

-

Ark One, a credit-focused hedge fund in Hong Kong, is set to launch later this month.

-

Antonio Cailao, a former director and head of investment grade credit trading at Barclays in Singapore, has joined ING, also in Singapore.

-

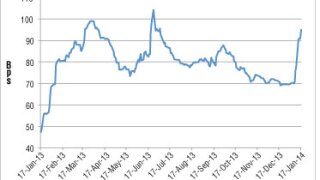

The last two years have seen a spike in credit options trading. Macro accounts, real money managers and pension funds have increasingly looked to the instruments to diversify their portfolios, with increased volumes expected in 2014 as investors realize the benefits of using options to hedge cash portfolios.