Derivs - Credit

-

Barclays has seen two senior departures on its credit trading desk. Toby Norfolk-Thompson, ex-director of credit derivatives trading and Aysha Suzuki, ex-structured credit trader, both in London, have left the firm.

-

Market participants have voiced concerns about the cross border implications of mandatory trade reporting under European Markets Infrastructure Regulation which came into force on Feb. 12.

-

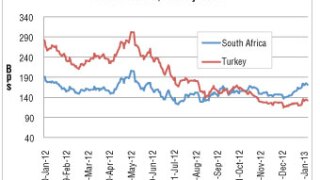

Capital flight from emerging markets has been the dominant theme in the credit markets so far this year, but over the past week the concerns have dissipated.

-

Benga Sofoluwe, the ex-head of securities lending and origination at hedge fund EQI Asset Management in London, is joining Citigroup in Hong Kong.

-

Regulators won’t be able to use data collected from trade repositories to spot risk straight away, market participants say. The deadline for mandatory trade reporting under European Markets Infrastructure Regulation passed on Wednesday.

-

Amid all the talk of an emerging markets “crisis,” credit spreads in the western world took a breather as participants awaited crucial economic data in the U.S.

-

Markit has chosen Koscom, a financial services provider based in Korea, to distribute its credit default swaps data via its terminal network. Markit’s iTraxx Asia indices, as well as global sovereign and corporate CDS data, including Korean data, will be accessible via Koscom’s terminals.

-

Hedge funds have been buying receivers and receiver spreads and selling out-of-the-money payers on iTraxx indices this week, signaling a bullish stance on Europe versus the U.S.

-

Scottish Widows Investment Partnership is entering into relative value trades on the North American CDX high yield index against its European equivalent the iTraxx Crossover.

-

Strategist at Barclays in New York have identified 10 names with a greater widening-to-tightening ratio in the North American CDX investment grade index than the index itself, for investors looking for a more favorable risk-reward trade-off than the index.

-

R. Martin Chavez, chief information officer for Goldman Sachs in New York, will receive the Outstanding Contribution Award at the Americas Derivatives Awards on April 22. Chavez, who was selected for the award by senior buyside and sellside officials active in the derivatives markets, will be honoured for his contribution to the development of the derivatives market through his role at the International Swaps and Derivatives Association, as well as his success in developing Goldman’s Equities Franchise, among other areas. The full list of award categories and nominees can be accessed at www.derivativesweek.com.

-

Emerging markets have a habit of triggering volatility compared to their developed market counterparties, as we have seen several times over the last 30 years. The trend was evident towards the end of January with fairly large swings in credit and equity.