Derivs - Credit

-

Lutz Goergen, a credit options trader at Goldman Sachs in London, is set to leave the firm.

-

German asset managers are rolling credit default swaps on single names in the iTraxx Main into longer dated maturities to gain from the steepness of the curve.

-

A mix of hedge funds and credit valuation adjustment desks are buying deep out-of-the-money payers with April expiries on the iTraxx Main and to a lesser extent the Crossover indices in what was a fairly active week in credit options. Flows skewed towards long volatility and hedging strategies.

-

Blythe Masters, head of the global commodities group and CIB regulatory affairs at JPMorgan in New York, is to leave the firm after 27 years. Masters is widely regarded by market participants as one of the leading figures active in the development of the credit derivatives market in the 1990s.

-

New credit default swap definitions published by the International Swaps and Derivatives Association last month could lead to the creation of a bifurcated market when they become effective from September, according to market participants.

-

Total trading volume in VIX futures during March 2014 increased 20% year-on-year, according to data from the Chicago Board Options Exchange.

-

Credit Suisse has launched structured notes on its Risk Appetite HOLT Relative Value USD Index. The so-called ProNotes offer investors 100% participation in the positive performance of the underlying.

-

Philip Brides, managing director, multi-asset and asset allocation trader at BlackRock in London, has resigned. He led a team of seven portfolio managers as head of BlackRock’s Institutional Global Tactical Asset Allocation mandates in Europe, Middle East and Africa.

-

Euronext has appointed three senior executives separately covering financial derivatives, commodities and cash equities.

-

Market participants are switching from trading credit options against indices to trading options outright in anticipation of the expiry of no-action relief from SEF trading for packaged trades on May 14.

-

CVA desks and hedge funds are buying outright payers and payer spreads on iTraxx Main as the index roll provided new impetus for investors looking to hedge.

-

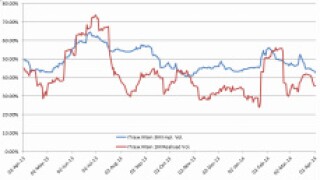

Last week saw a key micro event in credit markets, the semi-annual index roll, causing volumes on swap execution facilities to spike and hit new records in CDS index transactions.