Derivs - Credit

-

Contingent convertible bonds are trading slightly too cheap, according to strategists at Société Generale in Paris. The strategists have developed a pricing model that gives CoCos an average model price of 112, compared to a market price of 109.

-

The European Securities and Markets Authority has revised its guidelines on how UCITS should manage collateral received from over-the-counter derivatives and efficient portfolio management techniques, such as repurchasing, that entered into force on Feb. 18, 2013.

-

Pension funds and endowments in Europe are renegotiating their trading mandates to exploit the positive credit default swap-cash basis.

-

The European Parliament came a step closer to finalizing the banking union on Thursday when it reached a provisional agreement on the proposed single resolution mechanism, squeezing through the deal before Parliament goes to recess in April.

-

Geopolitical tensions and doubts over US monetary policy loom large, but one micro event in March tends to dominate the credit markets: the semi-annual index roll.

-

Paul Hawkins, ex-head of UK credit trading and sales at Santander in London, has left the firm.

-

Private banks are showing interest in credit linked notes on ArcelorMittal, the steel manufacturer, due to positive basis in credit default swaps on the name. The CLN comes after ArcelorMittal printed a five year benchmark offering on Tuesday.

-

Short gamma investors were seen scrambling to cover their positions in the European credit options market last week, which has since drove implied volatility upwards on the iTraxx Main.

-

Grant Biggar,the ex-president of Creditex in New York, has joined Algomi as a strategic advisor, also in New York.

-

Strategists at BNP Paribas are recommending investors take a tactical long position on the North American CDX high yield series 21 index against the S&P 500, ahead of the roll to series 22 on March 27.

-

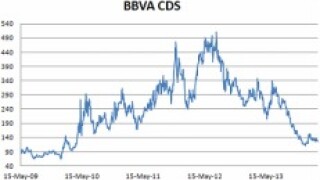

The CDS cash basis of the UK remained largely unchanged in the first quarter of 2014, according to the Bank of England’s quarterly bulletin. The basis had steadily decreased for the second half of 2013 because of increased confidence among investors and a growing willingness to bear risk, leading to an increase in the supply of protection and a decline in CDS premia.

-

The situation in Ukraine remains highly volatile, and growth appears to be flagging in China. Such a scenario would once have triggered risk aversion in the eurozone’s periphery, as well as in emerging markets.