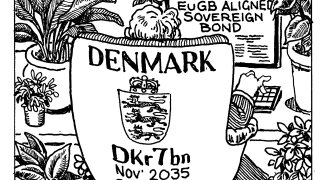

Denmark

-

◆ Record-breaking reset spread ◆ Issuer sails through previous 300bp barrier despite investor resistance ◆ Minimal new issue premium

-

Bankers say deals are still being launched and believe international rivalry can be negotiated

-

◆ Busy week for euro capital trades ◆ Fair value disputed ◆ 'Yield buyers' running the market, rival banker says

-

◆ Good reception for new bonds despite company profit downgrade ◆ Negative premium on all legs ◆ Longest maturity draws biggest book

-

Focus on diversification boosts activity across Australian, Canadian and Danish markets and many more

-

◆ One of the widest euro IPTs this year in IG corporate ◆ Demand rises during book building ◆ Single digit new issue premium

-

◆ Nykredit captures tight funding ◆ Issuer's last benchmark of the year ◆ Investors looking to pay the price to diversify into tight Nordic bank credits

-

Sovereign achieved ‘significant milestone’ but market participants hope to see more

-

◆ First EuGB from Denmark, won’t be its last ◆ 1.5bp greenium achieved versus conventional twin ◆ Sovereign deal 'completes EuGB asset class'

-

Sovereign will issue more European Green Bonds in future, and peers such as the Netherlands may follow

-

Capital raise consequence of the Trump administration's onslaught on renewables

-

Deal reflects ‘new paradigm’ in SSA market where spreads to US Treasuries grind ever tighter