Currencies

-

Fast money goes missing as issuers try to sell at tight spreads

-

Up to five years ‘the right place to go’ but the curve to 10 years could reopen soon

-

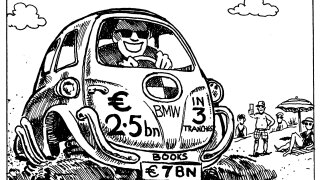

Dual tranche dollar deal breaks record despite tight US Treasury spread while cross-currency basis assists 'big win' in euros

-

Many in market say Europe has moved past poll worries, but issuer actions suggest otherwise

-

◆ MuniFin enters hard market ◆ Questions over demand in euros ◆ IFC goes for FRN

-

Final burst of issuance struck this week before expected dearth begins

-

-

Secondary holding up after unexpectedly busy week

-

Shorter deal fits mortgage origination pattern as investor appetite vanishes for ultra-longs

-

UK bank's second foray into the subordinated Aussie bond market

-

Central American supra has cut interest rates on loans to its members as it has gradually reduced its own cost of funding

-

◆ More supras fund in dollars ◆ ADB carries supply with more to come ◆ DBJ opts for no-grow