Currencies

-

◆ First deal since HSBC France takeover ◆ Rarity means wide range of fair value ideas ◆ Issuer eyes most popular point of the curve

-

Spread widening brings unexpected shift in orderbook composition in euros but other currencies tougher

-

German utility soothes flighty bond investors by mixing up usual market approach

-

Supranational remains ahead of the curve in completing its 2024-2025 funding task

-

◆ Near-record book for new dollar bond ◆ Euro on the menu as part of $10bn-$11bn programme ◆ No pick up to peers, no problem

-

◆ Tight govvie spread no problem for spread hunters ◆ No premium needed ◆ Some buyers resisted pricing through 70bp

-

Two day execution brings bank successful start

-

Development bank aims to continue early success in the dollar market next week

-

International banks launched a torrent of dollar FIG supply as they swatted away political uncertainty to get 2025 off to a rapid start

-

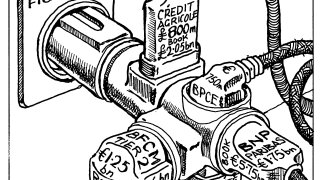

Warm reception for French banks in euros and other currencies shows FIG market is in positive health

-

Access to the UK market cannot be taken for granted

-

Elite group of companies now considered safer than France in the primary market