Currencies

-

◆ Issuers storm dollar market this week ◆ British Columbia follows Ontario to long end ◆ IDA taps two markets in two days

-

◆ Sovereign bags another huge book ◆ Rare five year paired with 12 year green tap ◆ €59bn raised from four syndications this year

-

Lenders sense appetite for M&A among companies, PE firms and lenders

-

◆ Carry turns less appealing for investors ◆ US bank holdco deals had pushed FRNs wider ◆ Opco vs holdco spread evaluated

-

Company drops sustainability-linking from loan

-

◆ More esoteric corporates head to euros ◆ London Power Networks makes euro debut ◆ Lagardère garners average demand despite eye-catching spread

-

The Canadian issuer may offer at least one more international benchmark this year

-

◆ La Banque Postale sells first euro benchmark of 2025 ◆ Mediobanca and DNB return ◆ Market 'to play catch-up' after scant supply in first five months

-

◆ Sterling return personal best for IFFIm ◆ Evolving spread, growing following ◆ Little to no new issue premium paid

-

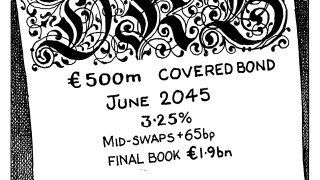

◆ Highly regarded issuer prints longest covered bond for three years ◆ Deal is more expensive than SSA debt... ◆... but investors show strong demand at 'fair' price

-

◆ Canadian issuers return to dollars ◆ AfDB brings rare dual-trancher ◆ Kommuninvest offers diversification

-

◆ IDA fair value more art than science ◆ MuniFin gets over 140 accounts in its book ◆ Madrid makes debut EuGB trade