Credit Suisse

-

Global gaming company Razer is planning to list in Hong Kong, and has filed a draft prospectus with the city’s stock exchange.

-

Bondholders and creditors remain at loggerheads over the restructuring of Mozambique’s debt following the publication of an independent audit of the country’s debt by risk assessment firm Kroll.

-

Dollar borrowers wrapped up their funding projects before the July 4 holiday weekend and dodged a global sell-off as central bankers pointed to the end of monetary stimulus.

-

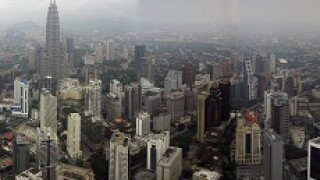

Lotte Chemical Titan Holding, the Malaysian arm of South Korean conglomerate Lotte Group, has finished bookbuilding for the largest Malaysian IPO since Astro Malaysia Holdings' listing in October 2012.

-

Fantasia Holdings Group returned to the high yield bond market for the second time this month, but was forced to pay heavily for a $300m deal.

-

FIT Hon Teng opened books this week for its potential HK$3.0bn ($384.3m) IPO and found investors scrambling to get in.

-

French media content producer Banijay is funding the acquisition of Castaway Television with its first ever bond. It has scheduled pricing for Friday, rising the tally of potential high yield bond sales above €2bn for this week.

-

Buyers considering Klöckner Pentaplast’s €1.6bn loan and Manutencoop's high yield bonds forced the issuers to sweeten terms this week, in a now rare sight in the leveraged finance market.

-

For emerging market bond investors, every crisis is an opportunity as inflows into the asset class continue to compress yields. Russia, commodity exporters and Mozambique are in focus this week.

-

Though some bankers have detected a cooling of investors’ thirst for European IPOs in recent weeks, the right names are still flying off the shelves. Delivery Hero, the online food ordering service, is guiding investors in its €866m deal to the top of the price range, and shares in restaurant chain Vapiano rose on their debut.

-

FIT Hon Teng, a subsidiary of Taiwanese electronics manufacturer Hon Hai, has opened books for its all primary IPO on the Hong Kong Stock Exchange, with a price range that could value the company at up to $2.6bn.

-

The IPO of Lotte Chemical Titan Holding, the Malaysian arm of South Korean conglomerate Lotte Group, is due to price towards the bottom of its initial range, according to a banker on the deal.