Crédit Agricole

-

Crédit Agricole Italia, SaarLB, OP and Tirol greatly boost covered confidence

-

Demand for its new 10 year trade finished above €137bn

-

Italy takes €15bn from dual tranche sale as bankers advise borrowers to keep going

-

◆ Second French bank deal in sterling in less than a week ◆ Issuer attracts £1bn-plus book due to lack of FIG supply in the currency ◆ OSB prepares senior return after September debut

-

◆ European banks lead issuance with focus on senior funding ◆ Market wobbles prove funding more challenging than expected ◆ Foreign banks’ capital raising is one prominent feature

-

Buyers grapple with falling interest rates

-

German issuer raised a whopping €9bn while two other SSAs together grabbed €2.5bn

-

◆ Issuer drives down yield by more than 200bp tighter than where other European national champions printed three months ago ◆ But this means smaller book that raises performance questions

-

Sterling remains king amid end of year flurry of deals

-

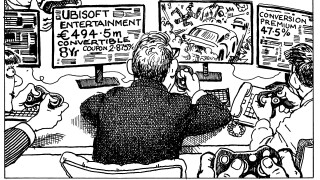

Shares in the French game publisher fell more than 8% after the convertible and delta placed

-

◆ FIG sterling issuance lagging higher sales of unsecured euros in 2023 ◆ Investors show readiness to buy as Pacific Life's second deal receives stronger demand at tighter spread ◆ UK insurer to offer long tier two

-

Banks may bring forward their 2024 funding plans to snap up duration as investors look to position ahead of predicted rate cuts