Top Section/Ad

Top Section/Ad

Most recent

Embattled utility makes final plea for court to sanction £3bn in emergency funding

Thames Water refinancing battle is an unedifying mess

Embattled utility asks judge to approve £3bn lifeline as creditor groups keep fighting

High yield issuers may be worried about market access, but some do not see them losing it

More articles/Ad

More articles/Ad

More articles

-

Asian debt borrowers were able to skirt market volatility for much of last week, selling more than $9bn of bonds. But the market slump hit Asia hard as the week drew to a close and the jitters continued on Monday morning.

-

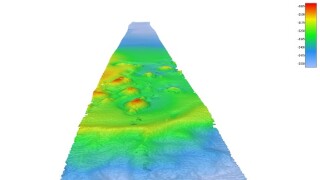

The only high yield bond deal being actively marketed in euros this week has been postponed. The deal was for Fugro, the Dutch company that provides geographical data and asset integrity services to onshore and offshore industries. It was a debut issue for a listed company with no sponsor involved, so there had been good interest, but market conditions just proved too difficult.

-

Three Chinese real estate developers braved a volatile market on Thursday, raising $800m as fears around the coronavirus continued to ravage secondary prices.

-

Leveraged finance investors are no shrinking violets, and held out longer than most against the rising pessimism caused by the coronavirus. But by Thursday, it was even giving high yield and leveraged loan players a sinking feeling.

-

Workers of the world’s capital markets united this week in efforts to keep the funding flowing as the threat of the Covid-19 coronavirus advances. Roadshows, mandate pitches and even quotidian office life faced emergency changes as embattled financiers braced themselves and their businesses for virus disruption.

-

Executives working on the $411m resale of Teekay Offshore Partners bonds by Brookfield, the Canadian asset manager, have slowed their work on the deal this week as high yield market conditions worsened amid growing concern about the coronavirus outbreak.