Top Section/Ad

Top Section/Ad

Most recent

◆ Issuers opt for extra guidance as market softens ◆ Enexis takes size at six years ◆ DSM-Firmenich lands tight

This week's flurry of deals takes year to date volume beyond £8bn

Tech giant's meditation on permanence offered investors a juicy a pick-up for taking just a little more duration risk

Disney joins tech giant with first dollar deal in over five years

More articles/Ad

More articles/Ad

More articles

-

Why have Indonesian state-owned companies seen resounding success in the dollar bond market this year amid the pandemic? Morgan Davis finds out.

-

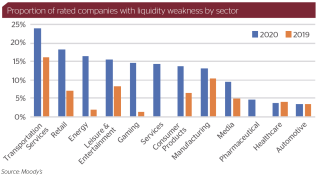

Debt was the answer to every problem in 2020, as companies tried to survive the coronavirus pandemic. Dusty revolving credit facilities that had never been touched were fully drawn, firms begged from governments, those that could flocked to the bond market. Now, with hope of the crisis easing, there is an awful lot of debt to clear up. Mike Turner reports.

-

The coronavirus has smashed the usual hierarchy of companies, large and small, creating new winners — and many losers. While 2020 was about finding ways to keep their financial lifeblood flowing, in 2021, more permanent solutions will need to be found. This will include bond funding for those still shut out — and M&A. Mike Turner reports.

-

European high grade corporate bond investors are gearing up for an unseemly bunfight over paper in the new year, as a lack of supply combines with plunging spreads. Corporate acquisitions could be one saving grace for investors, and liability management another. But, as Michael Turner reports, even if M&A and LM come up trumps, it's still going to be a tough few months for investors.

-

Cheesemaker Groupe Bel’s landmark US private placement under French law was funded this month. The company has sampled all the major sources of investment grade private capital in the recent past, having issued euro PPs and Schuldscheine before its new US PP.

-

Aroundtown, the Luxembourg-listed real estate company, has used its freshly printed bonds to buy back more expensive debt, as syndicate bankers press for more corporates to take advantage of cheap rates to conduct liability management exercises.