Top Section/Ad

Top Section/Ad

Most recent

Asian buyers driving callable SSA market have resurfaced in public benchmark deals

Public sector issuers have become more flexible when executing cross-currency interest rate swaps

Politically motivated prosecutions endanger democracy

Solutions exist but political will is necessary

More articles/Ad

More articles/Ad

More articles

-

Investors keep showing up for deals that cheapen on the break

-

-

Buyers other than fund managers are ramping up their ESG policies

-

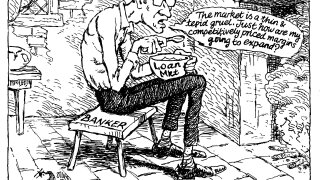

Without an effective regulatory sandbox, there is no secondary market, and without that, there isn’t progress

-

Going longer doesn’t seem as steep when everything is elevated

-

As spreads grind tighter on the latest negative event, it is time to bet that they have further to go