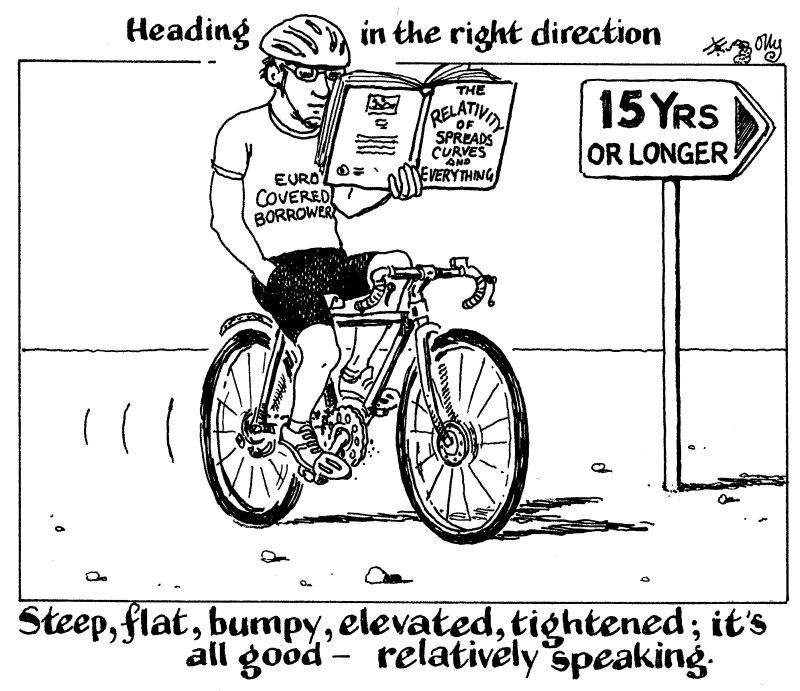

Caffil blew open the 15 year part of the covered bond curve with a monster €7.4bn book for its €500m 3.125% May 2039 public sector-backed deal on Tuesday. And with €6.9bn of orders left on the table, there is plenty of unfulfilled demand in the market.

“But what about the elevated spreads?” other bank funding officials cry, when asked if they will bring follow-on deals.

Yes, covered bond spreads are historically high: Caffil’s latest 15 year landed at 45bp over mid-swaps, 43bp wider than where the French borrower funded its last 15 year outing in February 2021, data from GlobalCapital’s Primary Market Monitor shows.

But spreads are not going to creep back down to the single digits any time soon. That said, Caffil’s latest has already tightened by more than 4bp, for instance.

So, instead of comparing new 15 year or longer deals with those sold more than two years ago in an entirely different market, where rates were lower and a central bank did a lot of the buying, treasurers should look in relation to the rest of the curve.

The long end of the covered curve is pretty flat. For Caffil, there was only 5bp of steepness between 10 and 15 years. Steeper than two years ago, maybe, but in 2024 this is a small price to pay for the duration.

The euro covered bond market is in a brave new world of almost double-digit spread tightening and minimal new issue concessions.

The strength of Caffil’s order book suggested there was room to crank the spread in tighter, had it been minded to do so.

The next borrower to wade into the longer reaches of the curve should be able to push pricing further. And perhaps, they could even mirror the bumper tightening possible in the belly of the curve.

After almost two years without even a sniff of anything longer than 12 years in euro covered bonds, investors have an appetite for duration to satisfy. Bank treasurers, it’s time to feed the beast.