Top Section/Ad

Top Section/Ad

Most recent

Asian buyers driving callable SSA market have resurfaced in public benchmark deals

Public sector issuers have become more flexible when executing cross-currency interest rate swaps

Politically motivated prosecutions endanger democracy

Solutions exist but political will is necessary

More articles/Ad

More articles/Ad

More articles

-

Volumes may be back to normal, but they're the only bit of the asset class that is

-

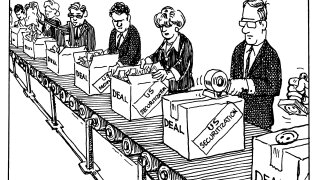

It may look opaque from the outside, but US securitization is mostly a straightforward production line providing crucial financing

-

Managers will need to be proactive in a market that can violently turn

-

Lower rates will give the market a boost even as other sectors curdle at the prospect of a recession

-

Investors know what a labelled bond is, they don't need sub-categories

-

No matter what system is most popular in the ECB Trials, objective thinking about distributed ledger tech rather than patriotism will decide the winner