Top Section/Ad

Top Section/Ad

Most recent

Asian buyers driving callable SSA market have resurfaced in public benchmark deals

Public sector issuers have become more flexible when executing cross-currency interest rate swaps

Politically motivated prosecutions endanger democracy

Solutions exist but political will is necessary

More articles/Ad

More articles/Ad

More articles

-

-

No reason for banks to fear going tighter still

-

It's more than gut feeling that FIG issuers should go for intermediate tenors

-

Issuers should learn the right lessons from Bank of America’s market-broadening deal

-

Tightening Japanese monetary conditions could shock markets worldwide

-

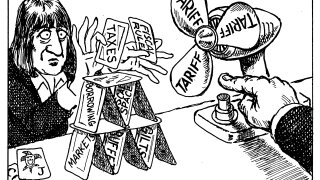

Canada's strong dollar deal suggests investors are looking beyond Trump threats