Top Section/Ad

Top Section/Ad

Most recent

Asian buyers driving callable SSA market have resurfaced in public benchmark deals

Public sector issuers have become more flexible when executing cross-currency interest rate swaps

Politically motivated prosecutions endanger democracy

Solutions exist but political will is necessary

More articles/Ad

More articles/Ad

More articles

-

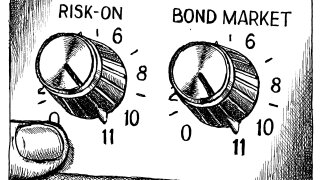

Ignoring terrible news is the only way to act in this market

-

Enjoy the roaring markets while you can, they won't last long

-

The difficulty of hitting the standard makes it a standard worth having

-

International investors are missing well-paying bank bonds

-

A fun and upbeat anti-Trump trading meme belies the trouble bubbling away in the guts of White House policies

-

Bank capital is a sentiment-driven product that is thriving in the present market mood