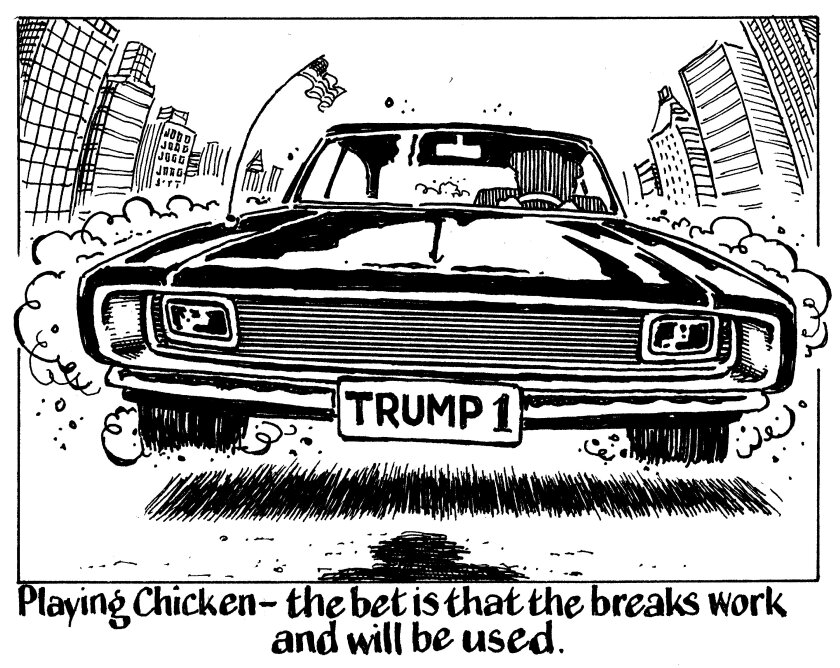

A popular acronym doing the rounds among investors is “Trump Always Chickens Out”, a reference to the strategy of assuming that US president Donald Trump will not follow through on his bombastic threats, such as aggressive tariffs on trading partners. But as with so much related to the mercurial president, this seems like a good idea — until it doesn’t.

The term “TACO trade”, coined by the Financial Times in May, has come to accurately describe the market’s reactions to Trump’s threats since April 2’s ‘liberation day’. That was when he imposed swingeing tariffs on just about every country — only to suspend most of them a week later.

The phrase was born after the rapid bounce-back of the S&P 500, gold prices and junk rated dollar bonds.

Europe’s investment grade corporate bond market was not above the mania. By the end of April, the S&P iTraxx Europe Main index of credit default swaps had tightened back to its April 1 level, after a 10bp widening.

The essence of TACO is that Trump never follows through with his wild threats, so it is worth trading financial assets based on that assumption.

It is easy to see why the maxim is attractive to investors. Financial markets love a snappy acronym, even if it is a bit nonsensical after more than surface-level thought (Brics, anyone?). And Trump certainly showed in April that he will back down if the bond market throws enough of a strop.

Now, markets are dealing with Trump’s 1,000-plus page ‘Big, Beautiful Bill’, a 2026 Budget which analysts reckon would add trillions of dollars to the US deficit.

A specific part of that bill, Section 899, is of particular concern to some parts of the market. It allows the US to impose increasingly harsh retaliatory taxes on the US investments of any entity, including individuals, based in a country deemed to have imposed “unfair foreign tax” on the US.

The mind-boggling legalese of Section 899 could mean almost anything.

Trump has so far backed down from the wildest of his economic ideas, but he has left himself ample space to completely change his mind at almost any stage — a strategy Trump calls “negotiating”.

But do all the lurches in one direction, then another, add up to a reliable or coherent economic policy?

They do not. There is no knowing when Trump might decide to dig his heels in and refuse to relent — as happened in his first term, when he insisted on renegotiating the North American Free Trade Agreement.

It was replaced with the Trump-approved United States-Mexico-Canada Agreement, only for Trump to throw that into disarray after his re-election.

Investors are obliged to remind customers ad nauseam that past performance is no guarantee of future results.

It would be wise for fund managers to remember that one place that applies more than anywhere else is the decision-making of the 47th US president.