Top Section/Ad

Top Section/Ad

Most recent

Benin reaped the rewards of its sukuk debut last week, and will do so for years to come

Little green men could be closer than they appear

Scrutiny of regulatory proposals by those without securitization expertise is a feature, not a bug

Weak or half-hearted response to Greenland threats will leave markets crumbling

More articles/Ad

More articles/Ad

More articles

-

Deutsche Bank jitters are spreading again, about seven months after the last round of panic washed over the troubled bank. The cause, this time, seems to be that German chancellor Angela Merkel ruled out a bailout, even if US regulators impose a settlement for RMBS mis-selling so large it threatens the solvency of the bank.

-

India has made great strides with the setting up of its first international financial services centre. The move is laudable, and most of the market feedback has been positive. But the authorities should not get complacent — a lot more needs to be done before the centre becomes the go-to destination for international capital market participants.

-

The European Union’s newly militaristic tone risks undermining the socially responsible activities of its pet bank.

-

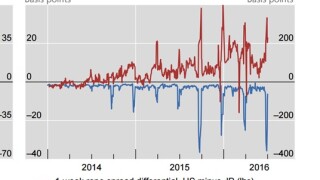

Chin-stroking academic studies have mostly failed to find evidence of the ‘liquidity crunch’ which investors and traders alike say has taken hold of bond markets in the wake of tougher regulation. Now that looks to be changing.

-

Hong Kong and China-based fintech lender WeLab could be a sign of things to come in the Asian syndicated loans market as the start-up seeks out its debut borrowing. Some banks will no doubt cast off the industry as a fad and give it a miss. But now is as good a time as any to take a fresh look at fintech.

-

Bund yields are close to their highest point since the Brexit vote on June 23. It didn’t take much to push them out and it likely won’t last long, but SSA borrowers need to grab their chance to fund in maturities that don’t get much action these days.