Top Section/Ad

Top Section/Ad

Most recent

Weak or half-hearted response to Greenland threats will leave markets crumbling

Over the last week the US president has pushed to make homes and consumer credit more affordable but these policies risk unintended consequences

Issuance volumes may be high but demand is even higher. Credit issuers in particular should take full advantage

Hounding the Fed does not make the US bond market more attractive

More articles/Ad

More articles/Ad

More articles

-

IPO after IPO fails in Europe, though equity capital markets in general work well. Look at the flotation process: it’s no surprise it malfunctions

-

As supply becomes scarcer, it will be easier for companies to sell dirty debt as green

-

Private equity sponsors are feeling the pain of a valuation mismatch. But an eager CLO market can help them as they alter their goals

-

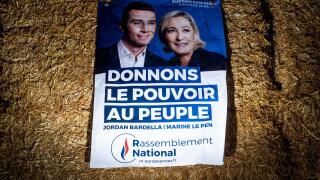

Some markets have shone, while others have been shuttered by political volatility

-

Tiering the Bank of England’s deposits has its place — but don’t go and zero them all

-

Spreads tighten as money chases assets but taking the easy money raises risks