Central and Eastern Europe (CEE)

-

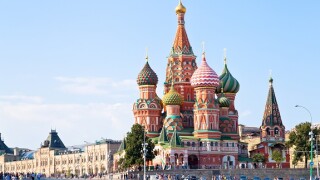

Samolet, the Russian real estate company, has launched the first leg of a two stage listing on the Moscow stock exchange, hoping to take advantage of a surge in demand from local retail investors this year.

-

The Baltic covered bond market is expected to take another stride forward with the advent of Latvia’s draft law, which currently is being debated in parliament. At the same time, the European Bank for Reconstruction and Development (EBRD) has been working closely with the Bulgarian, Croatian and Ukrainian authorities to help develop the basis for their own covered bond laws.

-

Aeroflot, the flag carrier of Russia, has finished the first leg of a jumbo recapitalisation backed by the Russian government, amid turmoil in the airline industry due to the Covid-19 global pandemic.

-

Polish e-commerce firm Allegro has soared in trading on its first day, giving a huge boost to equity capital markets after a difficult period for IPOs.

-

-

The Republic of Turkey on Tuesday raised a five year dollar bond that priced slightly outside of some fair value estimations. However, despite a series of negative events in recent months, including currency depreciation, investors are still keen on getting stuck into Turkish debt, investors say.

-

Shares in two companies, listed on Wednesday, are trading below their IPO price, with bankers blaming more volatile market conditions for the disappointing moves.

-

Sovcomflot, the state-owned Russian shipping company, will price its IPO at Rb105 a share, the bottom of it range.

-

Ukraine priced a $2bn 12 year bond on July 1, tightening pricing to 7.3% yield that was inside the expectations of many market participants as the country passed a major test of international investor acceptance with flying colours.

-

Hungary wasted little time in turning this year’s increased external funding needs into an opportunity to expand its green bond plans. Yet though sustainability is quickly climbing the list of priorities in Central and Eastern Europe, not all countries are likely to hop on the green bond wagon

-

Central and Eastern Europe had never been better prepared for a crisis than when Covid-19 hit, and the region’s governments faced few obstacles in ramping up external bond issuance this year. But there is uncertainty regarding what EU funding will mean for CEE volumes

-

Though China has increased co-operation with Central and Eastern European nations in recent years, provoking some concern in the EU, investment volumes remain muted. Non-EU nations in the Balkans, however, offer a chance to progress on the Belt & Road initiative