CEE Bonds

-

-

Sovereign green bonds are becoming almost commonplace in Europe, but not all are convinced. Slovakia has no intention to enter the market, saying it is a costly exercise that “would not help anyone”.

-

The Republic of Bulgaria issued a €2.5bn dual-tranche bond on Tuesday to support its expanding state budget, following a raft of its regional peers which are responding to the Covid-19 crisis with substantial deals.

-

During the last week, Turkey’s currency has hit damning lows and the sovereign has been given another credit downgrade. Many say these events should prompt the country to enact serious fiscal and monetary reforms.

-

The Republic of Bulgaria has mandated banks to arrange a dual tranche bond in euros, making it the latest sovereign to add to the swelling supply from the central and eastern European (CEE) region.

-

Hungary returned to the Samurai market after a two year absence on Friday to sell the first ever sovereign green bond in the market, which formed part of its ¥62.7bn (€500m) four tranche deal, which the sovereign used to extend its debt curve while also introducing a new investor base to the credit.

-

The Republic of Poland, the first European country to issue a Panda bond in August 2016, has finished the documentation process for its second onshore renminbi offering, GlobalCapital China understands.

-

Turkish lender Garanti BBVA has lost a director in its funding department.

-

The National Bank of Ukraine’s (NBU) decision to maintain interest rates against pressure to cut them was not enough reassurance for analysts worried about the broader reform agenda in the country. As the saga continues surrounding the ownership of one of its banks rumbles on, a number of obstacles stand in Ukraine’s path to recovery.

-

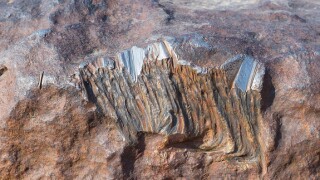

Norilsk Nickel, the Russian metal and mining company, was set to issue a benchmark dollar bond on Thursday evening, just months after it was found responsible for a series of major diesel spills.

-

Norilsk Nickel, the Russian metal and mining company which has found itself under heightened scrutiny in recent months after a series of major oil spills, is set to raise a dollar denominated benchmark bond this week. Russian telecom major Veon was also in the market for its second rouble offering in recent months.

-

Oleg Mukhamedshin, deputy chief executive of Rusal, which produces 9% of the world’s aluminium, tells Mariam Meskin how the company has weathered yet another rocky period in commodity markets. And how its sustainability credentials have been affected by oil spills at its affiliate, Norilsk Nickel, in May and June.