CEE Bonds

-

North Macedonia launched a new bond in euros on Wednesday, following deals last week from fellow central and eastern European sovereigns issuers, Serbia and Croatia.

-

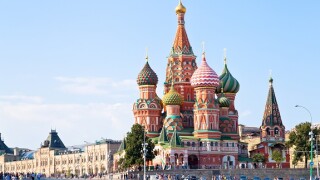

The City of Moscow will enter the bond market as soon as this spring, after a long hiatus from the market, according to a senior politician. The municipality has also set its sights on a green bond, which would mark a first for the government.

-

-

Serbia and Croatia issued euro-denominated bonds this week. Market participants said the deals showed there was strong appetite for the right kind of sovereign credits.

-

Croatia was set to price a bond in euros on Thursday, following two other EM sovereign issuances in the currency this week.

-

Serbia entered the bond market on Wednesday to sell a bond in euros, after entering both dollar and euro markets last year. Fellow Balkan sovereign issuer Croatia is expected to follow it, tapping investors as early as Thursday.

-

New sanctions from the EU on Russian figures following the imprisonment of opposition leader Alexei Navalny are set to have little impact on Russia, according to market experts. However, companies withdrawing from the Nord Stream 2 project indicate a growing uneasiness around conducting business with Russian entities.

-

EP Infrastructure, the Czech Republic-headquartered energy infrastructure group, launched a euro bond on Tuesday. By midday, books had almost reached €3bn.

-

Expectations of increased demand for emerging market local currency bonds are starting to wane, as the macroeconomic backdrop and interest rate volatility point to a stronger dollar in the short term.

-

EP Infrastructure, the Czech Republic-headquartered energy infrastructure group has mandated banks to syndicate a bond in euros. Though much of supply from the CEE region last year came from sovereigns, market participants believe now is a good time for corporates to issue in debt markets.

-

A sustained revival of confidence in Turkish markets has caused the lira and other metrics to improve in recent days. That, market participants said, has strengthened the country's standing in international debt markets to the point where it could consider a long dated new issue, though concerns around rising US rates are simmering away in the background.

-

Negotiations between the International Monetary Fund and some emerging market countries are yielding mixed results. While some sub-Saharan African sovereigns are making progress in their talks, Ukraine's long-running saga to unlock emergency funding has been unsuccessful so far.