CEE Bonds

-

Gazprom is asking for consent to modify the terms and conditions of its £500m 5.338% loan participation notes due 2020.

-

Rustavi Azot released price guidance for its $180m five year non-call three notes and now expects to price the bond on Monday.

-

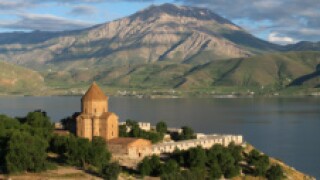

Armenian financial Ardshinbank priced a $100m five year amortising deal on Wednesday, and became one of only a handful of CEEMEA borrowers in recent years to offer a 12% yield.

-

The FIG market is in need of a core European champion to restore confidence after the less than stellar performance of the periphery on Wednesday, say bankers.

-

The Russian government has joined a growing group of sovereign CPI-linked bond issuers, and analysts expect the government to return for at least one more sale this year.

-

Armenia's Ardshinbank has released price guidance at a yield of 12% for a dollar five year amortising bond.

-

Rustavi Azot has released price guidance for its $180m five year non-call three notes at 11%-13% yield. The note is expected to be priced later this week.

-

Slovenia priced a €1.25bn 10 year transaction on Tuesday with only a single digit new issue premium, according to bookrunners. The thirst for duration should help encourage other European sovereigns.

-

CEEMEA is refusing to put its feet up for the summer. Slovenia has reopened European sovereign supply, Zambia is prepping a dollar benchmark and rarer names are offering old school emerging market yields in the double digits.

-

VTB's huge multi-tranche tender offer makes financial sense, but also demonstrates the pessimistic outlook for Russian growth at one of Russia’s biggest corporate lenders, despite this year’s rally in the country’s bonds.

-

Slovenia launched a 10 year euro benchmark on Tuesday, but decided against adding a 30 year tranche.

-

Gazprom is asking for consent to modify the terms and conditions of its £500m 5.338% loan participation notes due 2020.