BMO Capital Markets

-

Issuer also benefits from improving market tone as ‘every day is a little better than the last’

-

◆ BMO Kanga gets them hopping outside of Oz ◆ HSBC sells into Japan and beyond ◆ Innovative yen coupon floor

-

◆ Cross-border yen funding remains open despite volatility elsewhere ◆ HSBC firms up terms on senior Samurai from its Hong Kong bank ◆ BMO marketing senior deal in Australian dollars

-

Canadian issuer taps into three different currencies within one week

-

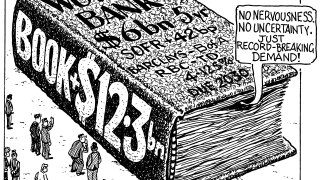

Canadian issuer takes bigger amount than originally targeted

-

Other SSA peers held back as market turned volatile

-

‘A number of milestones’ achieved from rare long-dated green issuance

-

◆ Market volatility no hindrance for foreign and domestic FIG issuers ◆ They take advantage of favourable conditions ◆ May volume to end more than 80% higher compared with a year ago

-

-

Redemptions, limited supply and a favourable rates outlook created a window for the issuer

-

German agency saw greater savings than what its sovereign was thought to have managed on the same day

-

Firms facing consequences from green commitments