BBVA

-

◆ Deal priced tight by a number of metrics ◆ Hefty oversubscription shows robust demand for FIG capital ◆ Trade clears flat to fair value compared with 10bp-15bp NIP for senior preferred at start of January

-

Demand for its new 10 year trade finished above €137bn

-

◆ Market reaches new equilibrium after swift spread widening last week ◆ Issuers pay 5bp-15bp of NIP on the day ◆ Long end especially popular as 10 year deals account for half of senior volume

-

Mexican lender falls short of bond size target as late 2023 momentum fades

-

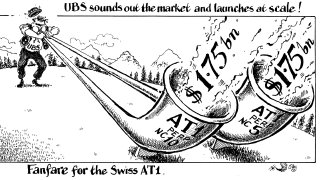

Investors pounce on Société Générale and UBS sales after yields rise, then rates rally to soothe fears

-

◆ SocGen and especially UBS garner huge demand for high yielding AT1s ◆ Red-hot interest suggests more European banks could issue in subordinated Yankees ◆ HSBC and BBVA raise $2.75bn in tier two

-

◆ Better market mood suggests more FIG capital issuance on the cards ◆ BBVA goes for longer tier two in dollars ◆ Some suggest UBS will issue AT1 as early as Wednesday

-

Spanish issuer attracts €2.3bn book as bankers emphasise borrowers shifting to dollar market

-

◆ Spanish bank obtains regional investor diversification and fresh capital ◆ Deal highlights subordinated funding is cheaper in dollars than euros ◆ Other banks should be encouraged to issue in dollars

-

◆ Spanish bank adds dollar AT1 to 2023 sub debt mix ◆ Deal attracts 'encouraging' European support despite recent local market outing

-

Whether to push on with supply or take a break divides participants

-

◆ Slimly subscribed deal spotted 2bp-3bp tighter ◆ Undersubscribed Santander UK senior deal also above par ◆ Sterling investors hope for a break in supply after difficult week