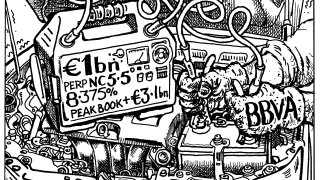

BBVA

-

-

Spanish agency served up 10th social bond as similarly labelled issuance has declined 10% year-on-year

-

The Spanish region served up its sustainable debut to raise €500m

-

Demand for high yielding paper drives comeback for most subordinated bank capital

-

Global head has assumed responsibility for primary as well as secondary credit markets

-

◆ Spanish litmus test for appetite after CS corrosion ◆ Pricing differed, books less so

-

◆ Spanish firm goes for price over size ◆ Slim 10bp concession needed to seal the deal ◆ Book builds appearing slower as the week progresses

-

Issuers must pay elevated premiums for new euro deals, but pricing still cheaper than dollars

-

Spanish bank taps Japanese rival to bolster credit trading

-

Bulging orderbook and no concession paid in first hybrid since Credit Suisse taken over

-

The €210m and €80m loans do not herald a wider array of new money transactions

-

Euro FIG market still awaits the return of pure bank credit